A Simple, Clear Guide to Understanding How Your Credit Score Works

A credit score is one of the most important numbers in your financial life. It can determine whether you get approved for a loan, how much interest you pay, and even whether you can rent an apartment.

But what exactly is a credit score? And how is it actually calculated?

In this easy-to-read guide, we’ll explain everything in plain language so you can fully understand how credit scores work and how to improve yours.

What Is a Credit Score?

A credit score is a three-digit number that shows lenders how reliable you are when borrowing money.

Most credit scores range from 300 to 850.

Here’s what the numbers generally mean:

-

800–850: Excellent

-

740–799: Very Good

-

670–739: Good

-

580–669: Fair

-

300–579: Poor

The most widely used scoring model is created by Fair Isaac Corporation, commonly known as the FICO Score.

Another model, called VantageScore, is developed by the three major credit bureaus.

The higher your score, the less risky you appear to lenders.

What Is a Credit Report?

Your credit score is based on your credit report.

A credit report is a record of your borrowing and repayment history. It includes:

-

Credit cards

-

Car loans

-

Student loans

-

Mortgages

-

Payment history

-

Current balances

-

Bankruptcies or collections

In the United States, three major credit bureaus collect this information:

-

Experian

-

Equifax

-

TransUnion

Each bureau may have slightly different information, which is why your credit score can vary slightly depending on where you check it.

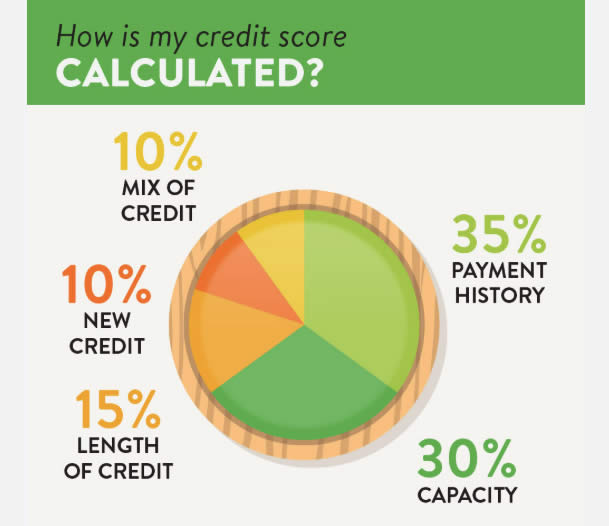

How Is a Credit Score Actually Calculated?

Although the exact formula is private, FICO publicly shares the five main factors used to calculate your score.

Let’s break them down in simple terms.

1. Payment History (35%)

This is the most important factor.

It answers one key question:

Do you pay your bills on time?

If you consistently make payments by the due date, your score benefits. If you miss payments, especially by 30 days or more, your score can drop significantly.

Late payments, collections, foreclosures, and bankruptcies all negatively impact this category.

Simple rule: Always pay at least the minimum payment before the due date.

2. Credit Utilization (30%)

This refers to how much of your available credit you are using.

Example:

-

Credit limit: $10,000

-

Current balance: $3,000

-

Utilization: 30%

Experts recommend keeping your credit utilization below 30%. Under 10% is even better.

Using too much of your available credit makes lenders think you may be financially stretched.

3. Length of Credit History (15%)

The longer your credit history, the better it looks to lenders.

This includes:

-

The age of your oldest account

-

The age of your newest account

-

The average age of all accounts

Closing old credit cards can shorten your credit history and possibly lower your score.

4. New Credit (10%)

Every time you apply for credit, a “hard inquiry” appears on your credit report.

Too many inquiries in a short time can lower your score slightly.

However, checking your own score does NOT hurt your credit. That’s called a soft inquiry.

5. Credit Mix (10%)

Lenders like to see that you can manage different types of credit responsibly.

There are two main types:

-

Revolving credit (credit cards)

-

Installment loans (car loans, student loans, mortgages)

Having a mix can help — but only if you manage them well.

What Does NOT Affect Your Credit Score?

There are many myths about credit scores.

Here’s what does NOT impact your score:

-

Your income

-

Your job

-

Your bank account balance

-

Your age

-

Checking your own credit

Your score only reflects how you manage borrowed money.

Why Your Credit Score Matters

Your credit score affects more than loan approvals.

It can influence:

-

Mortgage interest rates

-

Car loan rates

-

Credit card approvals

-

Apartment rentals

-

Insurance costs

-

Some job applications

A higher score can save you thousands of dollars over time.

For example, someone with a high score may qualify for much lower interest rates compared to someone with a low score.

Over 20–30 years, that difference can add up to tens of thousands of dollars.

How Often Does Your Credit Score Change?

Your credit score updates regularly.

It can change when:

-

You make a payment

-

You miss a payment

-

Your balance increases or decreases

-

You open or close an account

Most lenders report to credit bureaus once a month.

That means your score can change monthly.

How to Improve Your Credit Score

Improving your credit score takes time, but it’s possible.

Here are simple steps:

Pay All Bills On Time

Set up automatic payments if needed.

Keep Credit Utilization Low

Aim for under 30%, ideally under 10%.

Avoid Too Many Applications

Only apply for credit when necessary.

Keep Old Accounts Open

If they have no annual fees, they help your credit history.

Check Your Credit Report for Errors

Dispute incorrect information with the credit bureaus.

How Long Does Negative Information Stay?

-

Late payments: 7 years

-

Collections: 7 years

-

Hard inquiries: 2 years

-

Bankruptcy: 7–10 years

Over time, negative marks matter less if you build positive credit habits.

Do You Have Only One Credit Score?

No.

You actually have multiple credit scores.

Different lenders may use different scoring models. That’s why your score might look slightly different across various platforms.

Final Thoughts

A credit score is a number that represents your financial reliability.

It is calculated using five main factors:

-

Payment history

-

Credit utilization

-

Length of credit history

-

New credit activity

-

Credit mix

The two most important are paying on time and keeping balances low.

The good news is that your credit score is not permanent. It can improve with consistent, responsible financial habits.

Understanding how your credit score is calculated gives you control. And when you take control, you can open doors to better loan approvals, lower interest rates, and stronger financial opportunities